Content

If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Calculating cost of goods sold is simple and can be calculated monthly to keep track of progress or less frequently for more-established businesses. Again, assuming inflation or rising prices and that the use of LIFO is permissible, it https://business-accounting.net/ creates the highest COGS, which in turn minimizes profits and taxes. Various implicit factors – including competitor pricing, customer expectations, perceived value, and product demand – are all important considerations when it comes to pricing. But one explicit factor, your cost of goods sold – or COGS – is critical when it comes to setting your prices.

- The IRS has detailed rules for which identification method you can use and when you can make changes to your inventory cost method.

- The balance sheet lists your business’s inventory under current assets.

- It blends costs from throughout the period and smooths out price fluctuations.

- In order to understand the different types of knowledge management systems, organizations should know about the different types …

- The IRS allows several different methods , depending on the type of inventory.

- Instead, they are reported as a current asset on the company’s balance sheet.

- A business that produces or buys goods to sell must keep track of inventories of goods under all accounting and income tax rules.

Inventory shrinkage occurs when physical inventory levels are lower in reality than what has been recorded. Inventory shrinkage can occur due to issues like shipping damage, theft, or even human error. It’s an important metric to calculate because it’s necessary for maintaining a more accurate record in your accounting and tax calculations. Assuming prices go up over time, a LIFO business sells its most expensive products first. Since prices tend to increase over time due to inflation, a FIFO business will usually sell its least expensive products first. In the long run, this will decrease its COGS and increase its net income.

Cost of Goods Sold (COGS) Explained With Methods to Calculate It

If a company can reduce its COGS through better deals with suppliers or through more efficiency in the production process, it can be more profitable. For example, airlines and hotels are primarily providers of services such as transport and lodging, respectively, yet they also sell gifts, food, beverages, and other items. These items are definitely considered goods, and these companies certainly have inventories of such goods.

Is COGS an expense or liability?

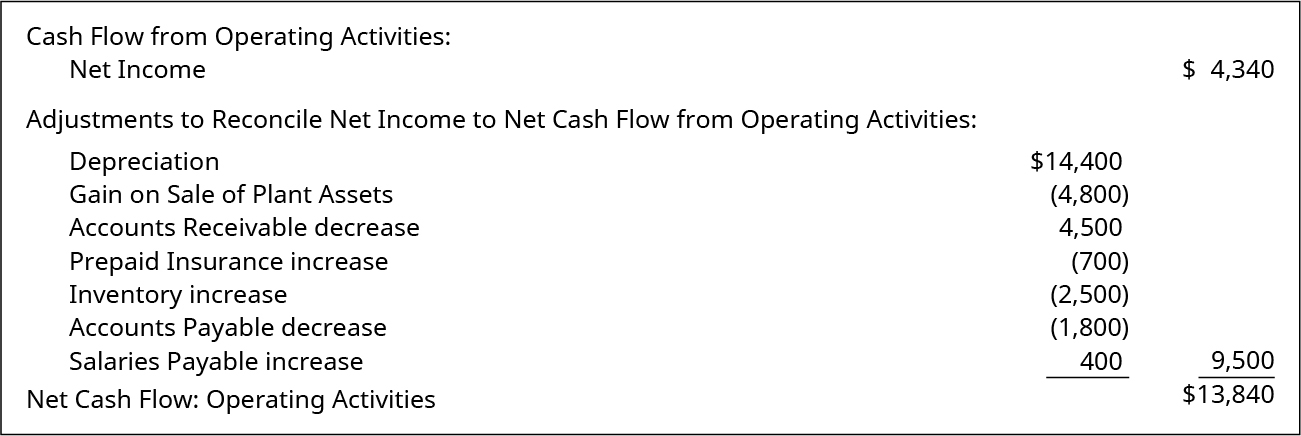

This means that the cost of goods sold is an expense. It appears in the income statement, immediately after the sales line items and before the selling and administrative line items. If there are no sales of goods or services, then there should theoretically be no cost of goods sold.

Thus, in an inflationary environment where prices are increasing, this tends to result in higher-cost goods being charged to the cost of goods sold. When it comes to managing the cash flow for your small business, staying on top of What Is Cost of Goods Sold costs related to production is critical. Square spoke to four small business owners in different industries. Specific identification is special in that this is only used by organizations with specifically identifiable inventory.

Cost of Goods Sold: What Is COGS and What’s Included?

A fixed cost is a cost that does not vary with the level of production or sales. The Inventory account is normally adjusted only at the end of the year. During the year the Inventory account will show only the cost of inventory as of the end of the previous year. The amount appearing in the general ledger Inventory account is not updated when purchases of merchandise are made from suppliers or when goods are sold. It’s so nice to see exactly what the average shipping cost is and make sure the number that my Shopify store has customers paying matches what’s in the ShipBob dashboard. Having those kinds of metrics on hand at any point is incredible.